staples tax exempt online order

Using black or blue ink make the check or money order payable to the Franchise Tax Board Write the California corporation number and 2020 Form 100S on the. Tax-exempt organizations may be shareholders in an S corporation.

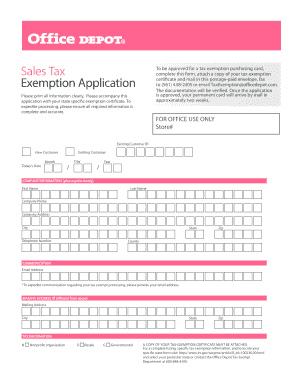

If the tax was paid by a corporation or a society the application must be signed by a director or by an employee who has been delegated authority.

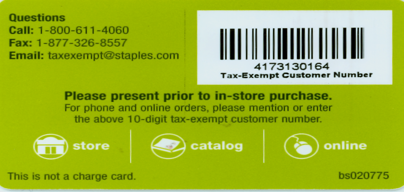

. To receive any discounts you must first be set up in their system. Fax your tax certificate to Staples at 18888238503. Interest income is taxed at your ordinary income tax bracket ranging from 12 up to 37 federal tax Blain says.

Educational institutions qualify for discounts on purchases made through the online USGS Store. We will keep your tax-exempt information on file until it expires at which time a new copy of your tax ID certificate will be. My order has been cancelled but I still have a charge on my credit card.

Procurement and Supply Chain Management must register all new vendors prior to an order being placed with a vendor or prior to any contractual relationship or other type of affiliation with a vendor. Fax your tax certificate to Staples at 888-823-8503. Please review the Instructional Guide to the Online Surplus Asset Disposition Tool.

Once a certificate is approved you can make eligible tax-exempt purchases in our stores. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Can I cancel the order or change the information on it.

Use the electronic barcode to check out in our stores with a tax-exempt purchase. To submit a surplus property pick up request please visit the Online Surplus Asset Disposition Tool. If the delinquency date falls on a.

Pacific Time on the delinquency date. Pursuant to California Revenue and Taxation Code Section 2922 Annual Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. Your order will be taxed and a refund generated as soon as our Tax Department verifies your tax exempt information.

And dont forget state taxes he adds. Do not attach staples clips tape or correspondence. On a cover sheet please include your telephone number and order number if applicable.

You may be required to provide evidence that the person who signed the application has the authority to sign. Clinical Engineering Research Equipment and Medical Surplus Property Disposal Requests. Franchise or Income Tax.

Prospective vendors are required to complete the Duke University Vendor Registration Form and supporting documentation. Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm. What Im really excited about and whats great news for potential applicants is that these positions fall under a special hiring condition called direct-hire authority which enables us to bring on successful applicants within 30-45 days of their job offer.

Please do not write on your tax certificate. Please do not write on your tax certificate. Do not use staples or other permanent bindings to assemble the tax return.

Can I get a discount if I order large. On a cover sheet please include your telephone number and order number if applicable. Get 247 customer support help when you place a homework help service order with us.

Please reference the following documents for additional information. Follow the instructions provided to fax or email your certificate. These positions include many entry-level clerk and tax examiner positions in my division.

I need printing services or assistance with a print order. If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps. Some states tax interest income up to 13.

An application that is not signed not signed by a signing. To check out with a tax-exempt purchase log into your account in the portal find your applicable tax-exempt certificate and click on Checkout Barcode. Please fax your request on school letterhead or on a purchase order to 303-202-4693 and include your Federal Tax ID number not to be confused with your Federal Tax Exempt Number.

Payments mailed to an address other than the address listed below including any Assessor Office that are received by the Los Angeles County Tax Collector after the delinquency date are delinquent and. Make your check or money order payable to the Los Angeles County Tax Collector. How do I apply to have a tax-exempt account.

Surebonder 5 16 Leg X 1 2 Crown Heavy Duty Staples 1 000 Count At Menards

Arrow T50 Multi Pack Staples 1 875 Count Sizes 1 4 Inch 3 8 Inch And 1 2 Inch Walmart Com

Sales Tax On Grocery Items Taxjar

Surebonder T50 1 2 Leg X 42 Crown Heavy Duty Staples 1 250 Count At Menards

Staples Com Customer Service Order Support

Staples Com Customer Service Order Support

Hyper Tough 25 Piece Coaxial Cable Staples Black Walmart Com

Surebonder 3 8 Leg X 1 2 Crown Heavy Duty Staples 1 000 Count At Menards

Sales Tax On Grocery Items Taxjar

Arrow T50 5 16 Staple Gun Staples 50524 Blain S Farm Fleet

Surebonder T50 3 8 Leg X 42 Crown Heavy Duty Staples 1 250 Count At Menards

How To Make Tax Exempt Purchases In Retail And Online Stores How To Make Money On The Internet

No 10 Staples By Craft Smart 4000ct Michaels

10 Off In Store During Tax Free Days Staples Com

Office Depot Tax Exempt Fill Out And Sign Printable Pdf Template Signnow